Universal basic Income scheme: 3 boon or curse for India

History of Universal Basic income scheme:

We must say Universal basic income scheme starts beyond the era we think, as it starts in the early 16th century.

Universal basic scheme was firstly profounded in the form of Minimum income: the humanists More (1516) and Vives (1526). The idea grants a minimum sum of money to some special group of people which were served by one of most rich people or huminst of the society. We can also say the universal basic income scheme initiated by the church of that time as the public assistance. These people are those whom were the exclusive preserve of the church.

The worst effect in that era due to universal basic income:-

The rate of murder of people increases instantaneously.

Universal basic income scheme 2nd round:-

The universal basic income starts once again as Basic endowment: the republicans Condorcet (1794) and Paine (1796), this time Universal basic income scheme starts to reflect social insurance.

The first known person to have sketched the idea is the first-rate mathematician and political activist, Antoine Caritat, Marquis de Condorcet (1743-1794). After having played a prominent role in the French revolution, both as a journalist and as a member of the Convention, Condorcet was imprisoned and sentenced to death, The idea rebirth a new regim to Europe and the world. This also pretend a new era of Universal Basic Income.

His idea starts to show a new era in the whole Europe.

Countries profounded with this Universal basic scheme:-

- Denmark:- By the end of the 20th century the Universal basic income started to flourish as a revolution in Denmark as the "citizen's wage".

- Development in Britain and Germany: In 1984, a group of academics and activists gathered around Bill Jordan and Hermione Parker under the auspices of the National Council for Voluntary Organizations formed the Basic Income Research Group (BIRG) – which was to become in 1998 the Citizen’s Income Trust. It doesn't reach mainstream politics. As This Universal Basic Income does not reach to main level of public I.e to the parliament of Nation.

- France:- In France, the debate got off the ground more slowly. The influential left-wing sociologist and philosopher André Gorz (1923-2007) initially defended a life-long basic income coupled to a universal social service of 20,000 hours (Gorz 1985). However, his fear of social life getting entirely colonized by paid employment drove him towards the defence of an unconditional income (Gorz 1997). In a very different vein, Yoland Bresson (1984, 1994, 2000), self-described as a “left Gaullist” economist, offered a convoluted argument for a universal ”existence income” supposed to be pitched at a level objectively determined by the “value of time”. Alain Caillé (1987, 1994, 1996), leader of the “Movement against Utilitarianism in the Social Sciences” (or MAUSS) advocated an unconditional income as the expression of society’s fundamental trust in those excluded from the labor market and in their ability and willingness to invest in activities of collective interest. And Jean-Marc Ferry (1995, 2000), a political philosopher in the Habermas tradition, developed a plea for a UBI as a right of citizenship at the level of the European Union, in a context in which he reckons full employment, conventionally understood, is forever out of reach and in which a “quaternary” sector of socially useful activities needs to be developed. The france now a day Whoming of the mission to the universal Basic income. The France starts in new year of Wyoming of Basic Universal Basic Income.

How we can say a income is universal basic income:-

A Basic Income, also called Universal Basic Income (UBI), Citizen's Income (CI), Citizen's Basic Income (CBI) (in the United Kingdom), Basic Income Guarantee (BIG) (in the United States and Canada), or Universal Demogrant, is a periodic cash payment delivered to all on an individual basis, without means test or work requirement. The incomes would be:

- Unconditional: A Basic Income would vary with age, but there would be no other conditions: so everyone of the same age would receive the same Basic Income, whatever their gender, employment status, family structure, contribution to society, housing costs, or anything else. Universal Basic Income celebrate or delebrate non-conditional Payment to everyone of the nation. Or upliftment for poor people.

- Automatic: Someone’s Basic Income would be paid weekly or monthly, automatically, into a bank account or similar. They are mostly poor.

- Nonwithdrawable: Basic Incomes would not be means-tested. Whether someone's earnings increase, decrease, or stay the same, their Basic Income will not change.

- Individual: Basic Incomes would be paid on an individual basis, and not on the basis of a couple or household.

- As a right: Everybody legally resident would receive a Basic Income, subject to a minimum period of legal residency, and continuing residency for most of the year.

Who supports univesal basic income scheme?

Tech titans in Silicon Valley like Tesla CEO Elon Musk and Facebook CEO Mark Zuckerberg are some of the biggest advocates of universal basic income. They say free money could provide flexibility for workers who could lose their jobs to robots or automation.

But the idea has been around for centuries. Philosopher Thomas Paine proposed payments "made to every person, rich or poor" in his 1797 work "Agrarian Justice."

In 1967, Martin Luther King Junior proposed a "guaranteed income" pegged to the median income level of society as a way to combat poverty.

Free-market champion Milton Friedman also advocated for a negative income tax, similar to basic income, as a way to simplify welfare and reduce bureaucracy.

Today universal basic income has support across the political spectrum. Senator Bernie Sanders has called it a "very correct idea" to address income and wage inequality, while some libertarians say it would provide a more efficient, simpler alternative to the existing welfare system.

Pilot project for universal basic income scheme:-

- Namibia: The amount paid out per head was N$100 (around US$12).

- South Africa:- The Democratic Alliance has advocated basic income. Under the name "the Basic Income Grant," South Africa experienced a major wave of political interest in UBI in the early post-Apartheid period.

- India:- Universal basic income has been studied in India for the 6 years from 2010-2016 in the district of Indore with the 9 villages. This pilot project conducted by the A NGO OF Ahmedabad colled NGO seva. The NGO give 150 rupees per month (under 18 year) and 300 rupees per month (above 18 year), while some other part 100 rupee (under 18 year) and 200 rupee (above 18 year). India has been considering basic income in India. On January 31, 2017, the Economic Survey of India included a 40-page chapter on UBI that outlined the 3 components of the proposed program: 1) universality, 2) unconditionality, 3) agency. The UBI proposal in India is framed with the intent of providing every citizen "a basic income to cover their needs," which is encompassed by the "universality" component. "Unconditionality" points to the accessibility of all to the basic income, without any means tests. The third component, "agency," refers to the lens through which the Indian government views the poor. According to the Survey, by treating the poor as agents rather than subjects, UBI "liberates citizens from paternalistic and clientelistic relationships with the state."

- Japan:- In Japan, New Party Nippon and the Greens Japan support basic income, along with some economists such as Toru Yamamori and Kaori Katada.

- MacAu:- Macau has distributed funds to all residents, permanent and non-permanent, since 2008, as part of the region's Wealth Partaking Scheme. In 2014, the government distributed 9,000 patacas (approx. US$1,127) to each permanent resident, and 5,400 patacas ($676) to non-permanent residents.

- South Korea:- The Socialist Party supported basic income, along with delegate Geum Min in South Korea.

- Iran:- Iran was the first country to introduce a national basic income in autumn 2010. It is paid to all citizens and replaces the subsidies of petrol, fuel, and other supplies that the country had for decades in order to reduce inequality and poverty. As of 2012, the sum corresponded to about 40 U.S. dollars per person per month, 480 U.S. dollars per year for a single individual and 2,300 U.S. dollars per year for a family of five people.

- Germany:- A commission of the German parliament discussed basic income in 2013 and concluded that it is "unrealizable" because:

- it would cause a significant decrease in the motivation to work among citizens, with unpredictable consequences for the national economy

- it would require a complete restructuring of the taxation, social insurance and pension systems, which will cost a significant amount of money

- the current system of social help in Germany is regarded as more effective because it is more personalized: the amount of help provided depends on the financial situation of the recipient; for some socially vulnerable groups, the basic income could be insufficient

- it would cause a vast increase in immigration

- it would cause a rise in the shadow economy

- the corresponding rise of taxes would cause more inequality: higher taxes would cause higher prices of everyday products, harming the finances of poor people

- no viable way to finance basic income in Germany was found

- Switzerland:- The basic income referendum The main arguments against basic income before the referendum, as interpreted by Martin Farley:

- It was a risky experiment

- It was a Utopian fairy tale with no basis in reality

- It would result in inflation if adopted

- The Swiss are not poor, so a Basic Income is not really required

- Switzerland already has a very good and effective system of social welfare, so it does not need to be replaced

- People should earn their income, not just receive it

- The proposal was prohibitively expensive and would require a huge increase in tax

- There was no plan in place to fund it

In the end, the proposal was overwhelmingly defeated with almost 77% voting against it.

Mahatma ghandhi on Universal basic scheme:-

“I will give you a talisman. Whenever you are in doubt, or when the self becomes too

much with you, apply the following test. Recall the face of the poorest and the weakest

man [woman] whom you may have seen, and ask yourself, if the step you contemplate

is going to be of any use to him [her]. Will he [she] gain anything by it? Will it restore

him [her] to a control over his [her] own life and destiny? In other words, will it lead to

swaraj [freedom] for the hungry and spiritually starving millions? Then you will find your

doubts and your self melt away.”

– Mahatma Gandhi

“My ahimsa would not tolerate the idea of giving a free meal to a healthy person who has

not worked for it in some honest way, and if I had the power I would stop every Sadavarta

where free meals are given. It has degraded the nation and it has encouraged laziness,

idleness, hypocrisy and even crime. Such misplaced charity adds nothing to the wealth of

the country, whether material or spiritual, and gives a false sense of meritoriousness to the

donor. How nice and wise it would be if the donor were to open institutions where they

would give meals under healthy, clean surroundings to men and women who would work

for them…only the rule should be: no labour, no meal.”

– Mahatma Gandhi

Universal basic scheme survey:-

A Universal Basic Income (UBI) is a periodic cash payment unconditionally delivered to all on an individual basis. It is not an entitlement but a right by virtue of being a citizen of a country. UBI is a step towards more equal society as it would promote Social equity, reduce poverty directly, and reduce risks related to unemployment, health etc. by providing a safety net. But, In India’s context the most important benefit would be in terms of addressing misallocation, exclusion and leakages which grapples plethora of schemes run by government to root out poverty and inequality.

Misallocation is due to administrative incapacity and inefficient delivery. Exclusion is a natural consequence of misallocation and Leakages are due to big and complex delivery system. UBI being delivered universally in bank account would address all the three problems. Added benefits would include increase in financial access due to increased volume of transaction which increases profitability of BC model of delivery. There are concerns that UBI would lead to increase in conspicuous consumption and dropout from the labour market but studies have found no evidence in this regard.

However, survey chalks out legitimate concerns. The success of UBI hings on success of JAM and still 1/3rd of adults don’t have bank account. The state and Centre need to agree on proportion of funding by each. Finally, taking away all schemes and benefits in lieu of UBI may not be politically feasible. The survey talks about floating the UBI scheme in gradual manner as a way forward.

Misallocation is due to administrative incapacity and inefficient delivery. Exclusion is a natural consequence of misallocation and Leakages are due to big and complex delivery system. UBI being delivered universally in bank account would address all the three problems. Added benefits would include increase in financial access due to increased volume of transaction which increases profitability of BC model of delivery. There are concerns that UBI would lead to increase in conspicuous consumption and dropout from the labour market but studies have found no evidence in this regard.

However, survey chalks out legitimate concerns. The success of UBI hings on success of JAM and still 1/3rd of adults don’t have bank account. The state and Centre need to agree on proportion of funding by each. Finally, taking away all schemes and benefits in lieu of UBI may not be politically feasible. The survey talks about floating the UBI scheme in gradual manner as a way forward.

Technical Terms

A. Characteristics of UBI scheme

A basic income has the five following characteristics:

Periodic: it is paid at regular intervals (for example every month), not as a one-off grant.

Cash payment: Allowing those who receive it to decide what they spend it on. It is not, therefore, paid either in kind (such as food or services) or in vouchers dedicated to a specific use.

Individual: It is paid on an individual basis—and not, for instance, to households.

Universal: It is paid to all, without means test.

Unconditional: It is paid without a requirement to work or to demonstrate willingness-to-work.

Periodic: it is paid at regular intervals (for example every month), not as a one-off grant.

Cash payment: Allowing those who receive it to decide what they spend it on. It is not, therefore, paid either in kind (such as food or services) or in vouchers dedicated to a specific use.

Individual: It is paid on an individual basis—and not, for instance, to households.

Universal: It is paid to all, without means test.

Unconditional: It is paid without a requirement to work or to demonstrate willingness-to-work.

B. JAM trinity – An abbreviation for Jan Dhan Yojana, Aadhaar and Mobile number. The government is pinning its hopes on these three modes of identification to deliver direct benefits to India’s poor. Subsidies cost the exchequer quite a bit. Yet, only a part reaches the poor because of intermediaries, leakages, corruption and inefficiencies. This is where the government hopes that the JAM trinity can help. With Aadhaar helping in direct biometric identification of disadvantaged citizens and Jan Dhan bank accounts and mobile phones allowing direct transfers of funds into their accounts, it may be possible to cut out all the intermediaries.

C. Randomize control Trials – In order to test the effect of a variable on a given subject, the subjects are divided into two groups with similar characteristics then the variable is introduced into one group and differences between two groups are studied to know impact of new variable. In UBI case it means taking two similar households and giving UBI to one and observing difference between two groups over a period of time.

D. How UBI does liberate citizens from paternalistic and clientelistic relationships with the state?

Clientelism is a political or social system based on the relation of client to patron with the client giving political or financial support to a patron (as in the form of votes) in exchange for some special privilege or benefit. Ex- voting for a party in exchange for future promised freebies. Because UBI would be Universal this incentive would be killed.

Clientelism is a political or social system based on the relation of client to patron with the client giving political or financial support to a patron (as in the form of votes) in exchange for some special privilege or benefit. Ex- voting for a party in exchange for future promised freebies. Because UBI would be Universal this incentive would be killed.

Paternalism is the interference of a state or an individual with another person, against their will, and defended or motivated by a claim that the person interfered with will be better off or protected from harm. UBI would be in cash so receiver could exercise his discretion to maximize his interests.

Gist of Economic Survey Chapter

Introduction

Despite making remarkable progress in bringing down poverty from about 70 percent at independence to about 22 percent in 2011-12 (Tendulkar Committee), it can safely be said that “wiping every tear from every eye” is about a lot more than being able to imbibe a few calories. It is also about dignity, invulnerability, self-control and freedom, and mental and psychological unburdening. From that perspective, Nehru’s exhortation that “so long as there are tears and suffering, so long our work will not be over” is very much true nearly 70 years after independence.

Idea of a radical option like UBI can be debated to achieve the above objective. UBI requires that every person should have a right to a basic income to cover their needs, just by virtue of being citizens. But there is a need to discuss and debate it pros and cons.

The Conceptual/Philosophical Case for UBI

It has three components: universality, unconditionality, and agency (by providing support in the form of cash transfers to respect, not dictate, recipients’ choices) and shows a radical shift in thinking about social justice and productive economy. It is based on idea that:

• Just society needs to guarantee to each individual a minimum income, and

• Which provides the necessary material foundation for a life with access to basic goods and a life of dignity.

• Which provides the necessary material foundation for a life with access to basic goods and a life of dignity.

It provides various social, economic and administrative benefits to individuals, society and nation.

A. Social justice

• It promotes many of the basic values of a society which respects all individuals as free and equal. It promotes liberty because it is anti-paternalistic; it promotes equality by reducing poverty.

B. Economic benefits

• It promotes efficiency by reducing waste in government transfers.

• System it may simply be the fastest way of reducing poverty.

• UBI is also, paradoxically, more feasible in a country like India, where it can be pegged at relatively low levels of income but still yield immense welfare gains.

• They allow for more non-exploitative bargaining in the labour market

• System it may simply be the fastest way of reducing poverty.

• UBI is also, paradoxically, more feasible in a country like India, where it can be pegged at relatively low levels of income but still yield immense welfare gains.

• They allow for more non-exploitative bargaining in the labour market

C. Administrative benefits

• A UBI is also practically useful. The circumstances that keep individuals trapped in poverty are varied; the risks they face and the shocks they face also vary. The state is not in the best position to determine which risks should be mitigated and how priorities are to be set and UBI restores decision making with citizens.

• By taking the individual and not the household as the unit of beneficiary, UBI can also enhance agency, especially of women within households.

• In India the case for UBI has been enhanced because of the weakness of existing welfare schemes which are riddled with misallocation, leakages and exclusion of the poor.

However, it is important to recognize that universal basic income will not diminish the need to build state capacity: the state will still have to enhance its capacities to provide a whole range of public goods. UBI is not a substitute for state capacity: it is a way of ensuring that state welfare transfers are more efficient so that the state can concentrate on other public goods.

• By taking the individual and not the household as the unit of beneficiary, UBI can also enhance agency, especially of women within households.

• In India the case for UBI has been enhanced because of the weakness of existing welfare schemes which are riddled with misallocation, leakages and exclusion of the poor.

However, it is important to recognize that universal basic income will not diminish the need to build state capacity: the state will still have to enhance its capacities to provide a whole range of public goods. UBI is not a substitute for state capacity: it is a way of ensuring that state welfare transfers are more efficient so that the state can concentrate on other public goods.

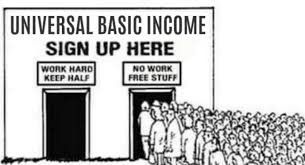

The Conceptual Case Against UBI

From an economic point of view there are three principal and related objections to a universal basic income.

A. The first is whether UBI reduces the incentive to work, which is highly exaggerated because the levels at which universal basic income are likely to be pegged are going to be minimal guarantees at best;

B. The second concern is, should income be detached from employment? But that is already done India in form of rich and privileged accepting non-work related income inherited from their parents. So, receiving a small unearned income as it were, from the state should be economically and morally less problematic than the panoply of “unearned” income our societies allow.

C. The third is a concern out of reciprocity. Should income be unconditional, with no regard to people’s contribution to society? Answer to this is that individuals do contribute to society. UBI in fact will recognize non-wage work by individuals like housewife.

D. Temptation Goods: Would A UBI Promote Vice?

• Detractors of UBI argue that, as a cash transfer programme, this policy will promote conspicuous spending or spending on social evils or temptation goods such as alcohol, tobacco etc.

• But NSSO 2011-12 data shows that these goods form a smaller share of overall budget/consumption as overall consumption increases. This provides an indication that an increase in income from UBI alone will not necessarily lead to an increase in temptation goods consumption.

• Detractors of UBI argue that, as a cash transfer programme, this policy will promote conspicuous spending or spending on social evils or temptation goods such as alcohol, tobacco etc.

• But NSSO 2011-12 data shows that these goods form a smaller share of overall budget/consumption as overall consumption increases. This provides an indication that an increase in income from UBI alone will not necessarily lead to an increase in temptation goods consumption.

E. Moral Hazard: Would A UBI reduce Labour Supply?

• It is argued that free money makes people lazy and they drop out of the labour market because their income levels have increased.

• However controlled trials of government cash transfer programs in 6 developing countries {Honduras, Morocco, Mexico, Philippines, Indonesia and Nicaragua where cash transfer formed between 4 percent (Honduras) and 20 percent (Morocco) of household consumption.} find no significant reduction in labour supply (inside and outside the household) for men or women from the provision of cash transfers. Similar results were obtained from trials in Indian villages from state of Madhya Pradesh.

• However controlled trials of government cash transfer programs in 6 developing countries {Honduras, Morocco, Mexico, Philippines, Indonesia and Nicaragua where cash transfer formed between 4 percent (Honduras) and 20 percent (Morocco) of household consumption.} find no significant reduction in labour supply (inside and outside the household) for men or women from the provision of cash transfers. Similar results were obtained from trials in Indian villages from state of Madhya Pradesh.

F. Another important question why universal basic income and why not targeted direct transfers.

Arguments in Favour and Against UBI

Counter arguments in favor of UBI

Despite all these arguments against UBI, there are various reasons which favor consideration of the idea of universalisation of the schemes, like:

Universalization prevents misallocation and diversion of resources. This can be more understood by analyzing the problems with present welfare schemes.

Large number of schemes:

• India has large number of social welfare schemes. The Budget for 2016-17 indicates that there are about 950 central sector and centrally sponsored sub-schemes in India accounting for about 5 percent of the GDP by budget allocation. Considerable gains could be achieved in terms of bureaucratic costs and time by replacing many of these schemes with a UBI.

Misallocation of resources across districts:

• The poorest areas of the country often obtain a lower share of government resources when compared to their richer counterparts. Under no scheme the poorest districts which have 40% of poor receive 40 percent of the total resources – in fact, for the MDM and SBM, the share is under 25 percent.

• This misallocation results into errors or inclusion of wrong persons and exclusion of genuine poor.An estimate of the exclusion error from 2011-12 suggests that 40 percent of the bottom 40 percent of the population are excluded from the PDS

• This misallocation results into errors or inclusion of wrong persons and exclusion of genuine poor.An estimate of the exclusion error from 2011-12 suggests that 40 percent of the bottom 40 percent of the population are excluded from the PDS

UBI cannot only help in overcoming these above mentioned issues, but will provide other benefits.

A. Improvement in Governance

• Misallocation to districts with less poor will be tackled because resources will be directly transferred to beneficiaries without involving bureaucratic hassles which result into misallocation.

• It will also reduce exclusion errors. Because it is by design universal.

• It will also reduce out of system leakages because JAM platform will be used to directly transfer benefits to beneficiary accounts.

• Misallocation to districts with less poor will be tackled because resources will be directly transferred to beneficiaries without involving bureaucratic hassles which result into misallocation.

• It will also reduce exclusion errors. Because it is by design universal.

• It will also reduce out of system leakages because JAM platform will be used to directly transfer benefits to beneficiary accounts.

B. Insurance against risk

It is found that slightly more than 50 percent of rural households across India face idiosyncratic (individual specific) shocks like bad health, job loss and aggregate shock like natural disaster and natural shock and make them vulnerable to poverty. UBI can prevent such poverty trap.

It is found that slightly more than 50 percent of rural households across India face idiosyncratic (individual specific) shocks like bad health, job loss and aggregate shock like natural disaster and natural shock and make them vulnerable to poverty. UBI can prevent such poverty trap.

C. Psychological benefit

The World Development Report argues that individuals living in poverty have

a) A preoccupation with daily hassles and this results in a depletion of cognitive resources required for important decisions;

b) Low self-image that tends to blunt aspirations;

An assured income could relieve mental space that was used to meet basic daily consumption needs to be used for other activities such as skill acquisition, search for better jobs, etc,and will improve psychological wellbeing.

The World Development Report argues that individuals living in poverty have

a) A preoccupation with daily hassles and this results in a depletion of cognitive resources required for important decisions;

b) Low self-image that tends to blunt aspirations;

An assured income could relieve mental space that was used to meet basic daily consumption needs to be used for other activities such as skill acquisition, search for better jobs, etc,and will improve psychological wellbeing.

D. Improved financial inclusion

Financial inclusion in India has progressed well under PMJDY, with ownership of bank accounts increasing to 2/3rd of adults and active usage to 40%, with only states like Bihar, UP, Jharkhand being laggard. However effective financial inclusion, in terms of active usage is constrained by two factors:

• Physical distance separating people from these bank branches: which is around 4.5 Km from any form of access point (ATM, BC, Bank etc)

• Number of persons per bank, which are very high in high population density like UP, Bihar etc. and greater burden on banks.

UBI can help in improving both these situations.

• UBI will help increasing financial inclusion by increasing bank transactions, increasing business per BC, reducing per unit fixed cost for BCs and thus increasing their numbers.

• At 90% financial inclusion rate with UBI of INR 12,000/person/year and 1% commission for BCs can reduce average distance from banking access point from 4.5Km to 2.5 Km and dramatically improving financial inclusion.

Financial inclusion in India has progressed well under PMJDY, with ownership of bank accounts increasing to 2/3rd of adults and active usage to 40%, with only states like Bihar, UP, Jharkhand being laggard. However effective financial inclusion, in terms of active usage is constrained by two factors:

• Physical distance separating people from these bank branches: which is around 4.5 Km from any form of access point (ATM, BC, Bank etc)

• Number of persons per bank, which are very high in high population density like UP, Bihar etc. and greater burden on banks.

UBI can help in improving both these situations.

• UBI will help increasing financial inclusion by increasing bank transactions, increasing business per BC, reducing per unit fixed cost for BCs and thus increasing their numbers.

• At 90% financial inclusion rate with UBI of INR 12,000/person/year and 1% commission for BCs can reduce average distance from banking access point from 4.5Km to 2.5 Km and dramatically improving financial inclusion.

E. Access to formal credit

Absence of assured income is a constraint for accessing formal credit. UBI can help in overcoming it. Debt and Investment Survey (2013) shows that

• As one moves along the consumption spectrum, the proportion of farmers taking informal loans falls and formal loans take over.

• That there is sudden increase in median loan amounts from zero to sudden increase at 78th percentile (INR 90,000/household/year).

It shows that if everybody’s consumptions could be increased to this level, there might be significant jump in access to formal credit. It also shows that as UBI amount increases more number of households will have access to formal credit, as more number of households will cross 78th percentile limit.

However, it may also occur that income threshold of 78th percentile group an increase and dampening the effect of UBI on releasing credit constraints.

A way forward depending upon the potential costs, fiscal space with governments can be analyzed and possibilities found out.

Absence of assured income is a constraint for accessing formal credit. UBI can help in overcoming it. Debt and Investment Survey (2013) shows that

• As one moves along the consumption spectrum, the proportion of farmers taking informal loans falls and formal loans take over.

• That there is sudden increase in median loan amounts from zero to sudden increase at 78th percentile (INR 90,000/household/year).

It shows that if everybody’s consumptions could be increased to this level, there might be significant jump in access to formal credit. It also shows that as UBI amount increases more number of households will have access to formal credit, as more number of households will cross 78th percentile limit.

However, it may also occur that income threshold of 78th percentile group an increase and dampening the effect of UBI on releasing credit constraints.

A way forward depending upon the potential costs, fiscal space with governments can be analyzed and possibilities found out.

What would be the potential cost of UBI?

The cost of UBI on government finances will depend upon the targets chosen and number of assumption. Based on 2011-12 poverty distribution and their consumption expenditure if a target poverty level of 0.45% is chosen, with UBI of INR 7620 per year (it corresponds to the annual consumption of marginal poor, who is at 0.45% threshold) and 75% coverage the financial cost of UBI will be 4.9% of GDP.

The cost of UBI on government finances will depend upon the targets chosen and number of assumption. Based on 2011-12 poverty distribution and their consumption expenditure if a target poverty level of 0.45% is chosen, with UBI of INR 7620 per year (it corresponds to the annual consumption of marginal poor, who is at 0.45% threshold) and 75% coverage the financial cost of UBI will be 4.9% of GDP.

Fiscal space to Finance a UBI

If we look at the present government welfare programs which are shown in fig., we find that:

• Subsidies for the non-poor/middle class households, equivalent to about 1 percent of GDP.

If we look at the present government welfare programs which are shown in fig., we find that:

• Subsidies for the non-poor/middle class households, equivalent to about 1 percent of GDP.

The middle class subsidies equal to the cost of a UBI of INR 3240 per capita per year provided to all females. This will cost a little over 1 percent of the GDP – or, a little more than the cost of all the middle-class subsidies.

However, taking away subsidies to the middle-class is politically difficult for any government. It is clear that while the fiscal space exists to start a de facto UBI, political and administrative considerations make it difficult to do this without a clearer understanding of its larger economy-wide implications.

However, taking away subsidies to the middle-class is politically difficult for any government. It is clear that while the fiscal space exists to start a de facto UBI, political and administrative considerations make it difficult to do this without a clearer understanding of its larger economy-wide implications.

Guiding Principle for Setting up a UBI

A. De jure universality, de facto quasi-universality

Using automatic exclusion criterion like:

• Ownership of key assets such as AC, automobiles

• Adopt a give up scheme

• Public display of UBI list, this would ‘name and shame’ the rich who choose to avail themselves of UBI.

• Self-targeting: under this Develop a system where beneficiaries regularly verify them in order to avail themselves of their UBI – the assumption here is that the rich, whose opportunity cost of time is higher, would not find it worth their while to go through this process and the poor would self-target into the scheme. However, this run counters to the objective of JAM trinity.

A. De jure universality, de facto quasi-universality

Using automatic exclusion criterion like:

• Ownership of key assets such as AC, automobiles

• Adopt a give up scheme

• Public display of UBI list, this would ‘name and shame’ the rich who choose to avail themselves of UBI.

• Self-targeting: under this Develop a system where beneficiaries regularly verify them in order to avail themselves of their UBI – the assumption here is that the rich, whose opportunity cost of time is higher, would not find it worth their while to go through this process and the poor would self-target into the scheme. However, this run counters to the objective of JAM trinity.

B. Gradualism

A guiding principle is gradualism: the UBI must be embraced in a deliberate, phased manner. A key advantage of phasing would be that it allows reform to occur incrementally – weighing the costs and benefits at every step. This can be done in following ways:

A guiding principle is gradualism: the UBI must be embraced in a deliberate, phased manner. A key advantage of phasing would be that it allows reform to occur incrementally – weighing the costs and benefits at every step. This can be done in following ways:

C. Choice to persuade and to establish the principle of replacement, not additionally

• Under this UBI is offered as a choice to beneficiaries of existing programs. Apart from having the normal advantages of cost reduction, giving choice to beneficiaries it will give them greater negotiating power with administrators, which will force latter to improve their performance.

• However it will have its own disadvantages of enforcing current problems with targeting, continues with the problem of misallocation with richer districts getting more, does not solve the problem of wrong exclusion and inclusion and will be cumbersome to administer.

• Under this UBI is offered as a choice to beneficiaries of existing programs. Apart from having the normal advantages of cost reduction, giving choice to beneficiaries it will give them greater negotiating power with administrators, which will force latter to improve their performance.

• However it will have its own disadvantages of enforcing current problems with targeting, continues with the problem of misallocation with richer districts getting more, does not solve the problem of wrong exclusion and inclusion and will be cumbersome to administer.

D. UBI for women

• It is worth considering because women suffer worse prospects in almost every aspect of their daily lives – employment opportunities, education, health or financial inclusion. Simultaneously, the higher social benefits and the multi-generational impact of improved development outcomes for women.

• A UBI for women can, therefore, not only reduce the fiscal cost of providing a UBI (to about half) but have large multiplier effects on the household. It will increase their bargaining power; reduce concerns of money being splurged on conspicuous goods and by factoring in children in household higher UBI can be provided to women.

However this has three problems of counting number of children, parents may go for more children and identification & phasing out of boys after they reach 18 years of age.

• It is worth considering because women suffer worse prospects in almost every aspect of their daily lives – employment opportunities, education, health or financial inclusion. Simultaneously, the higher social benefits and the multi-generational impact of improved development outcomes for women.

• A UBI for women can, therefore, not only reduce the fiscal cost of providing a UBI (to about half) but have large multiplier effects on the household. It will increase their bargaining power; reduce concerns of money being splurged on conspicuous goods and by factoring in children in household higher UBI can be provided to women.

However this has three problems of counting number of children, parents may go for more children and identification & phasing out of boys after they reach 18 years of age.

E. Universalize across groups:

Certain groups like widows, old age, divyang etc can be included under UBI net under phase-1 because these groups are easily identifiable. However this may suffer from less access to bank accounts and not part of JAM trinity.

Certain groups like widows, old age, divyang etc can be included under UBI net under phase-1 because these groups are easily identifiable. However this may suffer from less access to bank accounts and not part of JAM trinity.

F. UBI in urban areas:

Urban areas have proper banking infrastructure and as poor are less dependent on state for sustenance, a disruptive step like UBI will not be that tricky in these areas.

Urban areas have proper banking infrastructure and as poor are less dependent on state for sustenance, a disruptive step like UBI will not be that tricky in these areas.

Prerequisites for UBI

A. JAM

Financial inclusion is very necessary for success of UBI. In India considerable ground has been covered for JAM preparedness but still a lot needs to be done.

• 1/3 of population is still without bank account and most of them belong to vulnerable social groups like SC, ST, disabled etc.

• Though 26.5 cr. Jan Dhan accounts have been opened, but linkages with Aadhar lags in J&K and north east states.

• Though 1 billion Aadhar cards have issued, but there are instances of authentication failure in states like Jharkhand (49% failure rates) and Rajasthan (having 37% failure rates), which results into exclusion.

It is not clear, whether UBI will certainly result into fewer leakages. Given the amount of cash that will flow through the system under the UBI and the fungible nature of money, one could imagine a perverse equilibrium where the UBI results in greater capture by corrupt actors.

This, once again, reiterates the role of a transparent and safe financial architecture that is accessible to all – the success of the UBI hinges on the success of JAM.

A. JAM

Financial inclusion is very necessary for success of UBI. In India considerable ground has been covered for JAM preparedness but still a lot needs to be done.

• 1/3 of population is still without bank account and most of them belong to vulnerable social groups like SC, ST, disabled etc.

• Though 26.5 cr. Jan Dhan accounts have been opened, but linkages with Aadhar lags in J&K and north east states.

• Though 1 billion Aadhar cards have issued, but there are instances of authentication failure in states like Jharkhand (49% failure rates) and Rajasthan (having 37% failure rates), which results into exclusion.

It is not clear, whether UBI will certainly result into fewer leakages. Given the amount of cash that will flow through the system under the UBI and the fungible nature of money, one could imagine a perverse equilibrium where the UBI results in greater capture by corrupt actors.

This, once again, reiterates the role of a transparent and safe financial architecture that is accessible to all – the success of the UBI hinges on the success of JAM.

B. Center-state negotiations

UBI amount, sharing between center and state will be very crucial for success of UBI. All these will require complex negotiations between federal stakeholders.

Initially, a minimum UBI can be funded wholly by the center. The center can then adopt a matching grant system wherein for every rupee spent in providing a UBI by the state, the center matches it.

UBI amount, sharing between center and state will be very crucial for success of UBI. All these will require complex negotiations between federal stakeholders.

Initially, a minimum UBI can be funded wholly by the center. The center can then adopt a matching grant system wherein for every rupee spent in providing a UBI by the state, the center matches it.

Conclusion

UBI is a powerful idea whose time even if not ripe for implementation is ripe for serious discussion. UBI can help in wiping tears form all eyes, which Mahatma Gandhi dreamed of, but it would also have serious consequences in form of

• Uncompensated reward harming responsibility and effort;

• Effect on macro-economic stability of country; and

• Recognizing exit problem in India, UBI may become another add-on government programme,which would have come to mind of Mahatma Gandhi.

UBI is a powerful idea whose time even if not ripe for implementation is ripe for serious discussion. UBI can help in wiping tears form all eyes, which Mahatma Gandhi dreamed of, but it would also have serious consequences in form of

• Uncompensated reward harming responsibility and effort;

• Effect on macro-economic stability of country; and

• Recognizing exit problem in India, UBI may become another add-on government programme,which would have come to mind of Mahatma Gandhi.

Supplementary Reading

Left-wing views – Socialist and left-wing economists and sociologists have advocated a form of Universal Basic Income (UBI) as a means for distributing the economic profits of publicly owned enterprises to benefit the entire population (also referred to as a social dividend), where the basic income payment represents the return to each citizen on the capital owned by society. Basic income as a project for reforming capitalism into a socialist system by empowering labor in relation to capital, granting labor greater bargaining power with employers in labor markets, which can gradually de-commodify labor by decoupling work from income. Some thinkers view an income guarantee would benefit all workers by liberating them from the anxiety that results from the “tyranny of wage slavery” and provide opportunities for people to pursue different occupations and develop untapped potentials for creativity.

Right Wing View – For thinkers on the right, the UBI. seems like a simpler, and more libertarian, alternative to the thicket of anti-poverty and social-welfare programs. For their part, right-wing advocates of the UBI view it as a streamlined replacement for complicated welfare payments. For this reason, Milton Friedman, an economist known for his laissez-faire beliefs, wanted to replace all welfare with a simpler system that combined a guaranteed minimum income.

subsidiesliament’s committee on Le:-gal aff giairs (JURI) adopted a report on “Civil law rules on robotics” which considers the legal and economic consequences of the rise of robots and artificial intelligence devices. The report argues that development of robotics and AI may result in a large part of the work now done by humans being taken over by robots, so raising concerns about the future of employment and the viability of social security systems, creating the potential for increased inequality in the distribution of wealth and influence. To cope with those consequences, the report makes a strong call for basic income.

Right Wing View – For thinkers on the right, the UBI. seems like a simpler, and more libertarian, alternative to the thicket of anti-poverty and social-welfare programs. For their part, right-wing advocates of the UBI view it as a streamlined replacement for complicated welfare payments. For this reason, Milton Friedman, an economist known for his laissez-faire beliefs, wanted to replace all welfare with a simpler system that combined a guaranteed minimum income.

subsidiesliament’s committee on Le:-gal aff giairs (JURI) adopted a report on “Civil law rules on robotics” which considers the legal and economic consequences of the rise of robots and artificial intelligence devices. The report argues that development of robotics and AI may result in a large part of the work now done by humans being taken over by robots, so raising concerns about the future of employment and the viability of social security systems, creating the potential for increased inequality in the distribution of wealth and influence. To cope with those consequences, the report makes a strong call for basic income.

On the other hand, in June 2016, Swiss voters overwhelmingly rejected a proposal to guarantee an income to Switzerland’s residents, whether or not they are employed, an idea that has also been raised in other countries amid an intensifying debate over wealth disparities and dwindling employment opportunities.

Switzerland was the first country to vote on such a universal basic income plan, but other countries and cities either have been considering the idea or have started trial programs. Finland has introduce a pilot program for a random sample of about 10,000 adults who will each receive a monthly handout of 550 euros, about $625. The intent is to turn the two-year trial into a national plan if it proves successful.

Views from Experts : The Indian Statistical Institute hosted its 12th Annual Conference on Economic Growth and Development (ACEGD) on December 19-21, 2016. ACEGD’s plenary sessions included a 90-minute panel on universal basic income and its relevance for India.

This conference included a panel on UBI, featuring five economists: Debraj Ray (New York University), Kalle (Karl Ove) Moene (University of Oslo), Rajiv Sethi (Columbia University), Himanshu (Jawaharlal Nehru University), and Amarjeet Sinha (Government of Bihar).

Ray and Moene have jointly developed a proposal for what they call a “universal basic share” (UBS) in India. Like a UBI, a UBS would provide each citizen with regular unconditional cash transfers of an equal amount. However, in contrast to most UBI proposals, a UBS fixes the amount of these transfers to a fraction of the GDP rather than a specific monetary amount. Ray and Moene recommend that India dedicate 12% of its GDP to the provision of a UBS. They calculate that, at present, this would provide each adult citizen with a basic income approximately equal to the country’s poverty line.

The last two panelists, Himanshu and Sinha, argue that India should prioritize public spending on universal basic services, rather than simply distributing cash to individuals. About UBI, Himanshu states that the question is not whether it should be adopted, but why and when. While allowing that UBI is a good idea in principle, he maintains that it is not yet time to introduce such a policy in India, given that many in the country lack clean water, access to education, and other essential public goods. Sinha, expanding on Himanshu’s thesis, stresses that “we should not lose sight of the need to craft credible public systems” — and worries that a UBI would divert money and attention from necessary improvements of education, health, housing, and public infrastructure.

Switzerland was the first country to vote on such a universal basic income plan, but other countries and cities either have been considering the idea or have started trial programs. Finland has introduce a pilot program for a random sample of about 10,000 adults who will each receive a monthly handout of 550 euros, about $625. The intent is to turn the two-year trial into a national plan if it proves successful.

Views from Experts : The Indian Statistical Institute hosted its 12th Annual Conference on Economic Growth and Development (ACEGD) on December 19-21, 2016. ACEGD’s plenary sessions included a 90-minute panel on universal basic income and its relevance for India.

This conference included a panel on UBI, featuring five economists: Debraj Ray (New York University), Kalle (Karl Ove) Moene (University of Oslo), Rajiv Sethi (Columbia University), Himanshu (Jawaharlal Nehru University), and Amarjeet Sinha (Government of Bihar).

Ray and Moene have jointly developed a proposal for what they call a “universal basic share” (UBS) in India. Like a UBI, a UBS would provide each citizen with regular unconditional cash transfers of an equal amount. However, in contrast to most UBI proposals, a UBS fixes the amount of these transfers to a fraction of the GDP rather than a specific monetary amount. Ray and Moene recommend that India dedicate 12% of its GDP to the provision of a UBS. They calculate that, at present, this would provide each adult citizen with a basic income approximately equal to the country’s poverty line.

The last two panelists, Himanshu and Sinha, argue that India should prioritize public spending on universal basic services, rather than simply distributing cash to individuals. About UBI, Himanshu states that the question is not whether it should be adopted, but why and when. While allowing that UBI is a good idea in principle, he maintains that it is not yet time to introduce such a policy in India, given that many in the country lack clean water, access to education, and other essential public goods. Sinha, expanding on Himanshu’s thesis, stresses that “we should not lose sight of the need to craft credible public systems” — and worries that a UBI would divert money and attention from necessary improvements of education, health, housing, and public infrastructure.

Boon of Univeral income scheme in india:-

- A large sum of money uses to be spend by government on the subsidies, according to the data released by the Goverment of India about 40% of total subsidies given by government are bogus or looted. Universal basic scheme help to decrease these scams. Each and every benifit given to the public directly.

- Universal basic income scheme help to save money on services and save time.

- Goverment will directly connected with the public.

Curse of universal income scheme for india:-

- Universal income scheme tends to rise in inflation, ultimately led to led rise in the cost of service of products and led to same society level.

- Outflow of money starts in more speed I.e most part go outside the countries.

- India will become a consumer alter than a producer.

Comments

Post a Comment